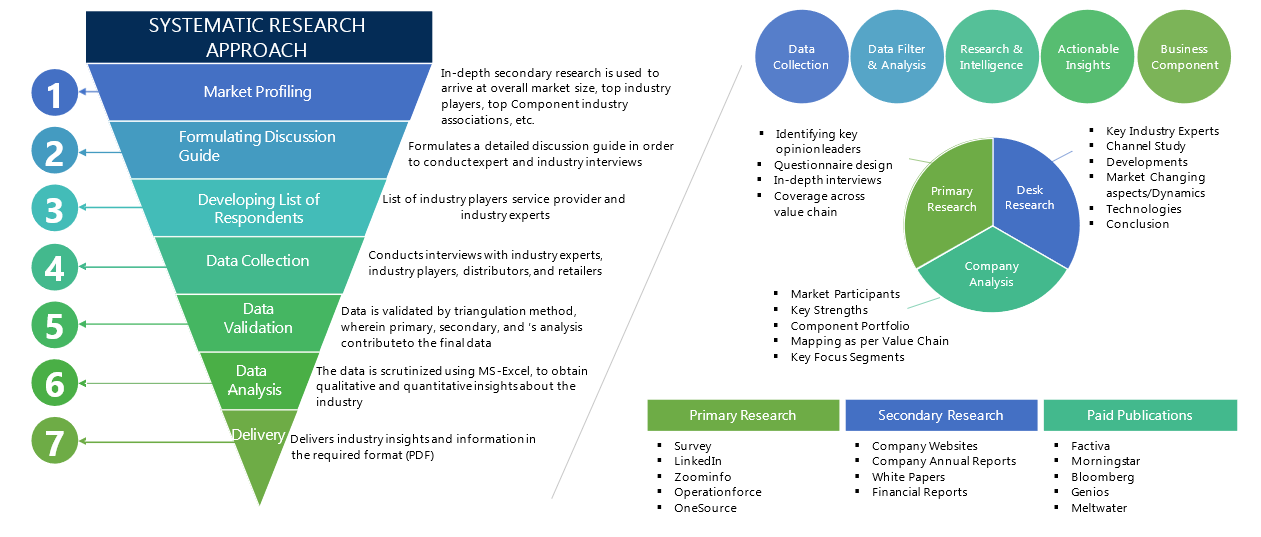

The process of market research is an iterative process in nature and usually follows following robust path. Information from secondary used to build data models, then results from data models are validated from primary participants. Then cycle repeats where, according to inputs from primary participants, additional secondary research is done and new information is again incorporated into data model. The processes continue till desired level of information is not generated.

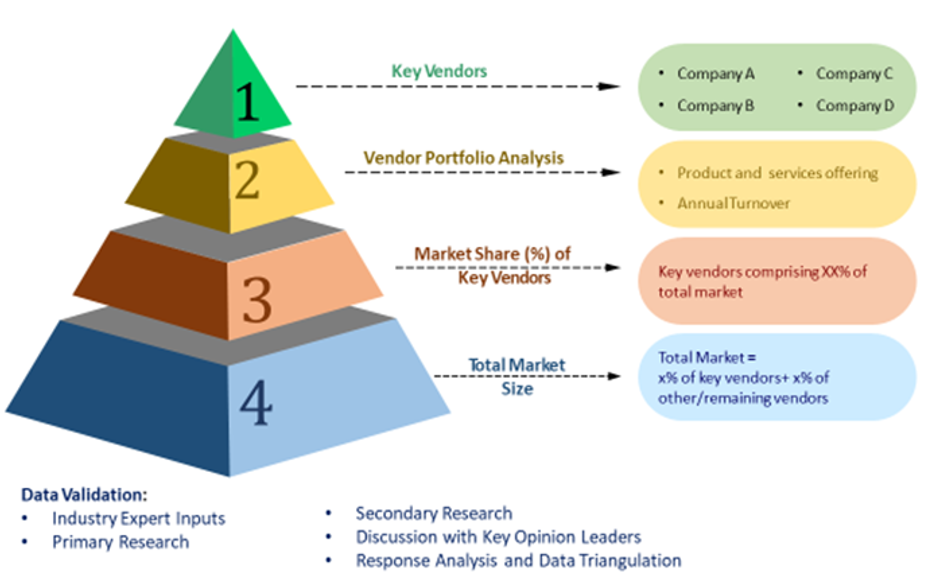

To calculate the market size, the report considers the revenue generated from the sales/subscription of a market. The revenue generated from the sales has been calculated through primary and secondary research. The report also presents the key players operating in the Market across the globe identified through secondary research and a corresponding detailed analysis of the top vendors in the market. The market size calculation also includes segmentation determined using secondary products and verified through primary products.

1.1 Secondary Research

The secondary research products that are typically referred to include, but are not limited to:

- Company websites, annual reports, financial reports, broker reports, investor presentations and SEC filings

- Internal and external proprietary databases, relevant patent and regulatory databases

- National government documents, statistical databases and market reports

- News articles, press releases and web-casts specific to the companies operating in the market

1.2 Primary Research

We conduct primary interviews on an ongoing basis with industry participants and commentators in order to validate data and analysis. A typical research interview fulfills the following functions:

- It provides first-hand information on the market size, market trends, growth trends, competitive landscape, future outlook etc.

- Helps in validating and strengthening the secondary research findings

- Further develops the analysis team’s expertise and market understanding

- Primary research involves E-mail interactions, telephonic interviews as well as face-to-face interviews for each market, category, segment and sub-segment across geographies

The participants who typically take part in such a power rating include, but are not limited to:

- Industry participants: CEOs, VPs, GMs, Marketing country heads, market intelligence managers and national sales managers

- Purchasing managers, technical personnel, distributors and resellers

- Outside experts: Investment bankers, Private Equity and Venture Capitalist firms

- Key opinion leaders specializing in different areas corresponding to different industry applications

1.3 Statistical Models

Where no hard data is available, we use modeling and estimates in order to produce comprehensive data sets. A rigorous methodology is adopted in which the available hard data is cross-referenced with the following data types to produce estimates:

- Demographic data: Population split by segment

- Macro-economic indicators: GDP, etc.

- Industry indicators: Expenditure, Product stage & Ultra-Low Volume, sector growth and facilities.

- Data is then cross-checked by the expert panel.

1.4 Supply Based Analysis

Supply based analysis is used to predict the supply in the market based on the product on capacities by market players. This approach is largely used in the case of established markets that have a stable demand during the historic period. The market supply is always estimated to be greater than the market demand for function availability. The market of the global contract research development organization was estimated based on the number of the players operating in the market. The revenues of the players were determined, and the data was further bifurcated based on the number of the services provided by the players operating in the market. Additionally, the segmental revenue of the company was also calculated, thereby leading to the overall calculation of the global market size for the contract research organization.

1.5 Demand Based Analysis

Demand analysis was performed by evaluating and estimating the demand from the end-users. The pharmaceutical and biotechnology companies, academic & research institutes, and medical device companies are some of the major end users of the CRO services. The number of the end-users using the CRO services was analyzed. The demand is anticipated to be cyclic in nature, depending on the end-function and quest for other alternate services.

1.5.1 Global/Country Based Analysis

The global level analysis is the analysis of the global level data about related markets, sources, trade & tariff and so on to understand the market scope. This is similar to understanding the parent market to provide a top-down analysis.

Country-level analysis understands of country-wise dynamics of a particular market. Country-level data is studied to provide a niche approach to the market. This data helps in the bottom-up analysis for the data collection activity.

1.6 Triangulation

Data triangulation technique was used to showcase the process of using data from two or more sources and arrive at a conclusion. Using primary interviews, the triangulated data is further validated by industry experts and subject matter experts. The approach was used to validate the data sets and information that were useful in the overall analysis and create actionable insights.

1.6.1 Primary Data

In order to provide our clients with the best function possible, our analysts interview several market-leading companies and industry experts for each research report. Interviews cover a broad range of issues from detailed technical function issues to insight into factors driving the sector at the local and macroeconomic level. Further supporting interviews are also performed with other industry stakeholders. These interviews are transcribed and published in full within our reports. We at Pharmanucleus passionately believe that only by consulting extensively with the industry thorough and accurate results be produced.

1.6.2 Secondary Data

Secondary research is performed by analyzing hundreds of contracts/sales data from a multitude of sources including company annual reports, SEC filings, contractual announcements, sales reports, company webpages, news reports, online and in-house databases, industry journals, and other statistical publications.

1.7 Market Size Estimation

1.7.1 Objective:

The objective of this market research report is to accurately estimate the market size of the pharmaceutical industry. The market size forecasting methodology will involve a systematic approach to analyze historical data, current market trends, and future growth prospects to provide reliable and actionable insights.

1.7.2 Data Collection:

Primary Data: Primary data will be collected through interviews, surveys, and discussions with key industry experts, pharmaceutical companies, healthcare professionals, and regulatory authorities. These interactions will provide valuable insights into market dynamics, trends, and drivers.

Secondary Data: Secondary data will be collected from reputable sources such as industry reports, market studies, government publications, regulatory databases, company websites, and financial reports. This data will help in validating and augmenting the primary data, providing a comprehensive understanding of the market.

1.7.3 Market Segmentation:

The pharmaceutical market will be segmented based on various factors such as therapeutic area, product type, distribution channel, and geography. This segmentation will enable a detailed analysis of each segment, allowing for a more accurate market size estimation.

Data Analysis:

Quantitative Analysis: The collected data will be analyzed using statistical tools and techniques. Quantitative analysis will involve evaluating historical market data, growth rates, and trends. Regression analysis and time series forecasting methods may be employed to identify patterns and project future market growth.

Qualitative Analysis: Qualitative analysis will involve interpreting the collected data and extracting meaningful insights. Factors such as market dynamics, regulatory environment, technological advancements, and competitive landscape will be considered to assess their impact on the market size.

1.7.4 Market Sizing Approaches:

a. Top-Down Approach: The top-down approach involves estimating the total market size based on macroeconomic indicators, industry reports, and market share analysis of major players. This approach provides an overall view of the market and serves as a starting point for further analysis.

b. Bottom-Up Approach: The bottom-up approach involves estimating the market size by aggregating data from individual segments and sub-segments. This approach provides a granular view of the market and allows for a more detailed analysis of specific product categories or geographic regions.

c. Market Penetration Approach: The market penetration approach involves estimating the market size based on the penetration rate of pharmaceutical products in the target population. This approach considers factors such as disease prevalence, treatment rates, and patient demographics to calculate the potential market size.

1.7.5Forecasting Techniques:

Trend Analysis: Historical data will be analyzed to identify underlying trends and patterns. These trends will be extrapolated to forecast future market growth.

Expert Opinion: Inputs from industry experts and key stakeholders will be incorporated to validate and refine the market size forecast. Their insights will be used to account for factors not captured by quantitative analysis alone.

Sensitivity Analysis: Sensitivity analysis will be conducted to assess the impact of various assumptions and variables on the market size forecast. This analysis will help evaluate the robustness of the forecast and identify potential risks or uncertainties.

1.7.6 Report Presentation:

The market size forecasting results will be presented in the research report using tables, charts, and graphs. The report will provide a comprehensive overview of the methodology employed, assumptions made, and the rationale behind the market size estimation. It will also include a discussion of the key findings and recommendations based on the forecasted market size.